Improve cash flow oversight with automated accounts receivable management

Improving your cash flow overview is not always easy. A lack of overview creates a lack of cash flow; in fact, you don’t know exactly what you’re missing. Standard cash flow statements in Excel or accounting programs lack deep insight or real-time linkage.

Do you also want to get paid faster? No more manual follow-up, but get an immediate grip on your finances? Then it’s time to improve your cash flow overview. How? You will find out in this blog post.

This article in 30 seconds

- Cash flow statements provide insight into your financial situation. It shows your incoming and outgoing cash flows.

- A good cash flow statement is essential for any healthy business because it shows the immediate availability of cash.

- Many companies still use traditional cash flow management, such as manual accounting or spreadsheets. This has many limitations such as:

- Delays

- (Human) Errors

- Lack of time

- Outdated information

- Accounts receivable software offers capabilities that traditional accounting does not. It gives:

- Insight into your incoming and outgoing cash flows

- Easy contact with partners and clients

- Measures taken faster

- Monitoring and thus more accurate forecasts

- Real-time insight allowing you to make decisions based on current and recent data

- Automated accounts receivable management improves your cash flow statement.

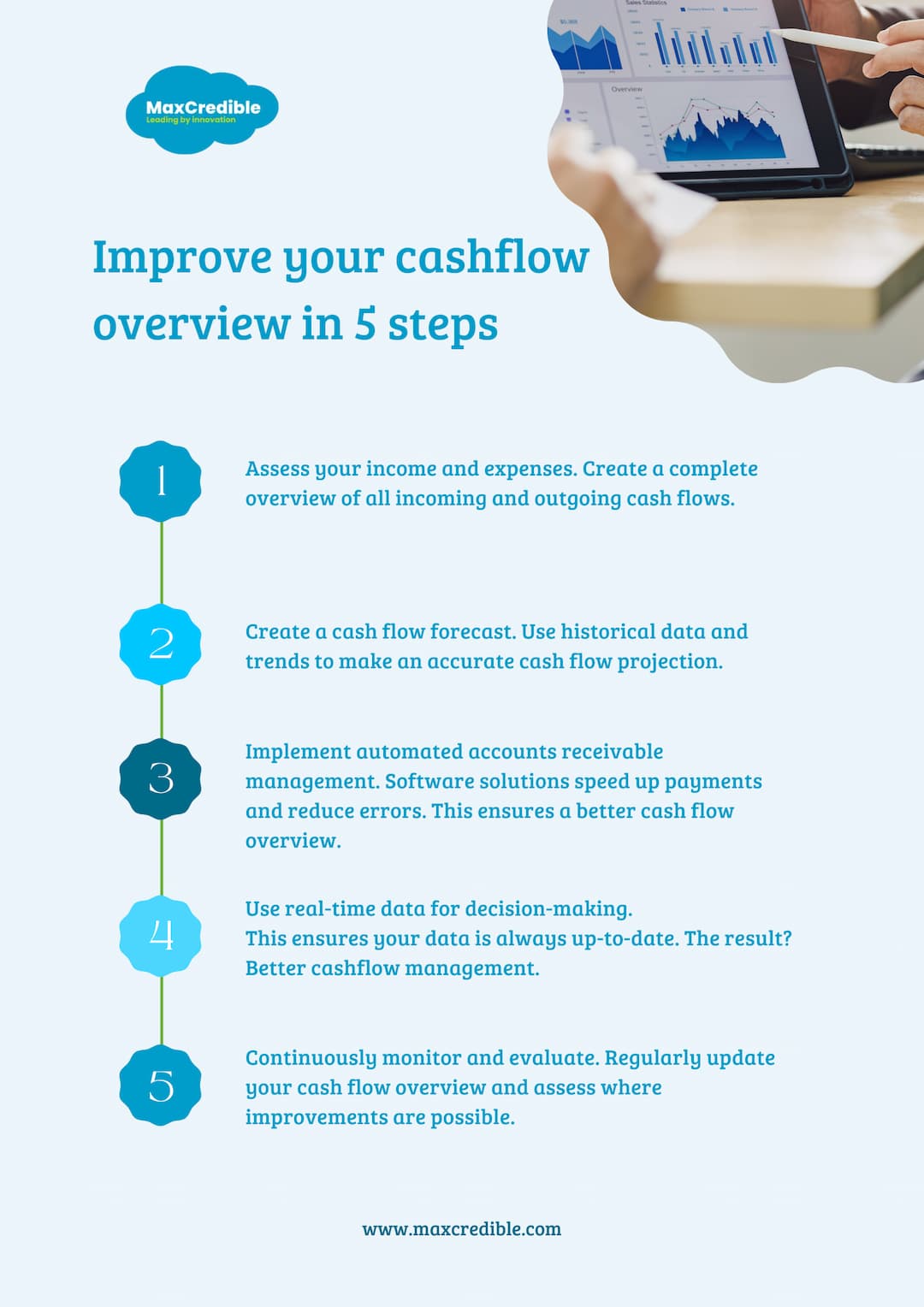

- Improve your positive cash flow in 5 steps:

- Step 1: Inventory your receipts and expenses

- Step 2: Create a cash flow forecast

- Step 3: Implement automated accounts receivable management

- Step 4: Use real-time data for decision-making

- Step 5: Monitor and evaluate continuously

- Automated accounts receivable management offers several features that help improve cash flow. Consider, for example:

- E-invoicing

- Personalized reminders

- Customer portals

- Real-time reporting

- MaxCredible’s credit management system automates your accounts receivable management very easily. From personalized communications to a customer portal and real-time reporting.

- Enjoy invoices paid up to 50% faster!

- Try MaxCredible’s credit management software very easily 7 days free of charge. Questions or doubts? Contact MaxCredible:

- ☎️ +31 (0)20 344 9070

- 📧 servicedesk@maxcredible.com

What is a cash flow statement and why is it important?

A cash flow statement provides insight into your incoming and outgoing cash flows. Effective cash flow management gives you essential insight into your customers’ payment behavior. It also shows exactly how much liquid assets (cash) are available. This overview is essential for any healthy business. Unlike an income statement, which shows the profitability of your business, a cash flow statement focuses on the ready availability of money.

The challenges of traditional cash flow management

Many companies still use traditional cash flow management. These include manual tracking of customers, or perhaps accounting through standard accounting software without advanced automation. This traditional cash flow management has many limitations. Manual processes and standard software lead to delays and errors.

Manually following up with customers, such as sending emails based on self-created statements rather than automated reminders, takes time. In doing so, it increases the likelihood of inaccuracies. Moreover, real-time data is lacking, so decisions are based on outdated information. The result? Poor operational cash flow.

In short, a clear cash flow statement is incredibly important for any business. It helps prevent liquidity problems, making your business financially stronger.

Real-time data in your cash flow statement

Real-time data in your cash flow is essential for effective cash flow management. By having continuous visibility into your incoming and outgoing cash flows, you react immediately to financial changes. Risks are reduced and measures are taken more quickly.

The solution is cash flow monitoring. With real-time cash flow monitoring, you make more accurate forecasts. Thus, you will discover cash flow problems faster. Always be prepared and make better decisions based on up-to-date data.

From overview to insight with automated receivables management

How do you improve your cash flow statement? Through automated receivables management. You reduce outstanding invoices because payments are made faster. Where employees are normally employed, automated systems can save time. Automated credit management saves time-consuming tasks and reduces the risk of errors. This gives you more control over your incoming cash flow.

What tasks are then eliminated thanks to automated receivables management?

There are tasks that are eliminated thanks to automated accounts receivable management. Think of tasks such as:

- Sending reminders

- Following up on payments

- Processing disputes

In fact, these tasks are performed automatically. This saves time and prevents human error. In addition, automated management provides a better overview of your current financial situation.

Unlike traditional accounts receivable management, automation provides efficiency and predictability. That’s why many companies choose to use a modern credit management system and automated accounts receivable management. It is simple and saves an awful lot of time and money. As a result, employees and processes become more efficient. Your job as a credit manager does not become redundant, but much more enjoyable!

What can I do with automated accounts receivable management?

You can pick up countless additional functionalities thanks to automated accounts receivable management. Not only that, it also offers possibilities for personalized messages, such as payment reminders. You easily customize the templates yourself, so no one notices that the reminders are not sent personally.

In addition, a customer portal allows debtors to easily view their invoices and make payments. This gives you real-time reports that can be seen in a dashboard. Instant overview of your financial data, it can be that simple.

Practical steps to improve your cash flow statement

Want to improve your positive cash flow statement? Then try the following steps.

improve your cash flow overview in 5 steps

Step 1: Inventory your receipts and expenses

Create a complete record of all incoming and outgoing cash flows.

Why? Because this gives a clear picture of your current financial position and shows where any bottlenecks are.

How? By categorizing payments as customer payments, vendor charges, fixed charges and variable expenses.

Step 2: Create a cash flow forecast

Use historical data and trends to create an accurate cash flow forecast.

Why? This helps you estimate future cash flows and prepare for any shortfalls or surpluses.

How? By analyzing historical payment data (such as DSO) and making monthly forecasts. Use forecasting modules in software such as MaxCredible’s here. Tip: Set up a buffer. This helps in case of unforeseen circumstances.

Step 3: Automate your accounts receivable management

Consider using software solutions to automate the accounts receivable process.

Why? Because it speeds up payments and reduces errors. Automation saves you time, which contributes to better cash flow visibility.

How? Implement software for automatic payment reminders, reminders and follow-up.

Step 4: Use real-time data for decision-making

Use real-time data for decision-making. Real-time insights allow you to take immediate action on deviations in your cash flow.

Why? This way, your data is always up-to-date. This ensures better cash flow management.

How? By setting up notifications for anomalies. Consider delayed payments or declining cash flows.

Step 5: Monitor and evaluate continuously

Continue to update your cash flow statement regularly and evaluate where improvements can be made.

Why? This ensures that you remain flexible and can react quickly to changes in your financial situation. This allows you to adapt your processes to circumstances.

How? Set goals for KPIs, such as DSO and payment deadlines. If necessary, organize monthly reviews with your team(s). Implement at least one improvement action each quarter.

Automate with MaxCredible

Automation thus saves time and money. By having less manual input and administrative burden, you increase efficiency and reduce human error. This makes your accounts receivable process faster and more reliable.

With MaxCredible you will get your invoices up to 50% faster. Real-time insights into your customers’ payment behavior allow you to save up to 80% time savings by automating repetitive tasks.

In addition, automated accounts receivable management leads to improved customer relationships. By leveraging these benefits of automation, you get more out of your cash flow and move from reactive to proactive financial management. Less stress, more certainty, and a clear path to growth.

Ready for this step? Then take it together with MaxCredible. In fact, MaxCredible’s credit management system offers all these options. Some directly, others through partners.

How does automated accounts receivable management improve my cash flow oversight?

Automated accounts receivable management offers several functionalities that help improve cash flow. How. Consider, for example:

- Personalized reminders

- Customer portals

- Real-time reporting

All in all, automated accounts receivable management ensures a streamlined and efficient process. The benefits of automation are clear:

- Improved cash flow, with invoices paid up to 50% faster through automatic reminders and follow-up.

- More efficient processes as you spend up to 80% less time on accounts receivable management through automation.

- Better customer relations, thanks to professional, automated communication, while payment delays decrease.

Real-time insight allows you to respond quickly to financial changes and prevent problems before they arise.

With automation, you get the most out of your accounts receivable management and significantly improve your cash flow statement. Up to 80% less time wasted, 30% faster invoice payments, lower risk of defaults and improved customer relationships. So your business focuses more on growth and stability.

MaxCredible: The solution for your accounts receivable management

MaxCredible offers the solution that transforms your accounts receivable management. Our credit management system automates all aspects of the process, from personalized communications (such as payment reminders) to a customer portal and real-time reporting.

Thanks to the software, invoices are paid up to 50% faster, reducing your team’s workload. The result is a thriving cash flow. MaxCredible helps you optimize your cash flow and keep your business financially healthy.

Conclusion

An accurate and real-time cash flow overview is essential for healthy operations. Automated accounts receivable management provides the solution for this. Take MaxCredible’s accounts receivable software, for example. By using this, you benefit from a variety of advantages. For example, it provides:

- Up to 50% faster

- Up to 80% less time spent on manual follow-up

- Real-time overview of outstanding invoices and payment behavior

- Lower risk of defaults

- Improved customer relations

- More efficient business processes

Are you using the real-time data from MaxCredible’s accounts receivable software? If so, you’ll get a better handle on your cash flow and your business will be financially stronger.

Therefore, consider using automated solutions to optimize your accounts receivable management. This will save you time, reduce errors and increase your cash flow.

Contact MaxCredible today and try our software 7 days for free! Find out how our solutions support your business with no obligation.